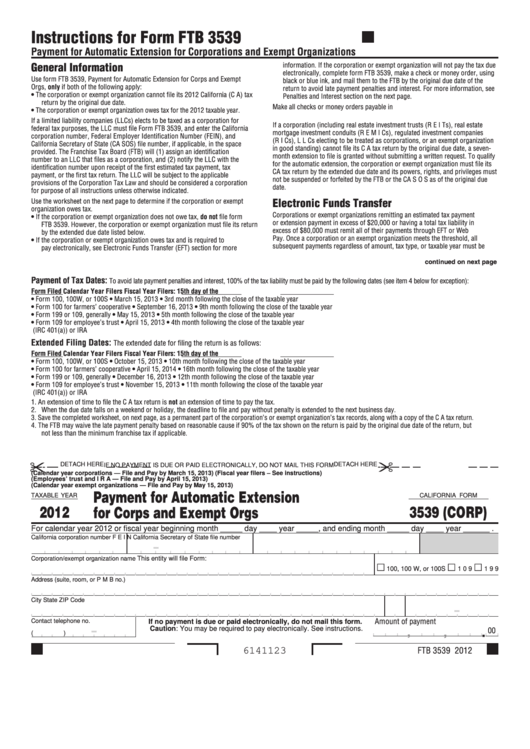

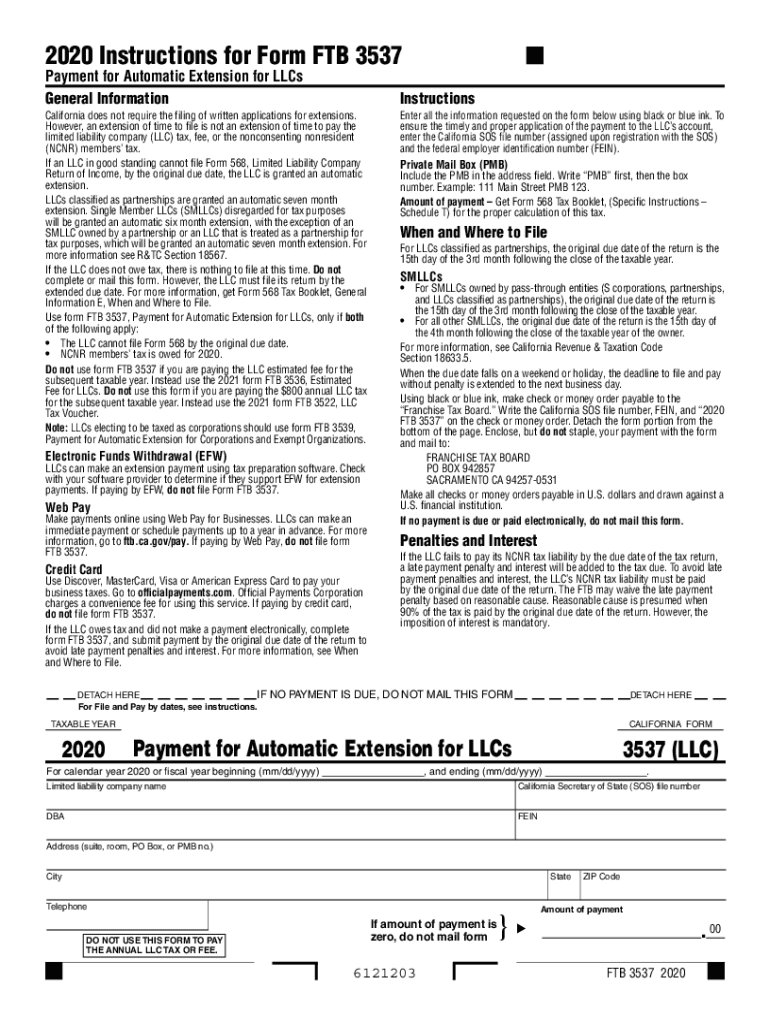

Certain categories of organization – including private foundations and nonexempt charitable trusts – must file regardless of gross receipts. Included in this notice were instructions for California organizations exempt from tax under California Revenue & Taxation Code section regarding Form 199, Exempt Organization Annual Information Return and Form 109, Exempt Organization Business Income Tax Return.įorm 199: Most California charities that exceed a certain gross receipts threshold are required to file an annual Form 199 (or an alternate version for smaller groups – the 199N). The California Franchise Tax Board recently sent out FTB Notice 2016-04 (11/4/16) with guidance on automatic extensions of time for various corporate entities in this state to file tax returns.

Automatic Extension for CA Information Returns Similarly, failure to file the required registration with the California Attorney General for a single year will result in the nonprofit’s tax-exempt status being suspended, and a 3-year failure will result in automatic revocation of status. For instance, failure to file Form 990 information returns for 3 years can result in automatic revocation of the federal tax exemption.

Failure to follow these filing requirements and deadlines can result in penalties and – sometimes – even harsher consequences. Directors and officers of tax-exempt organizations around the nation generally breathe a sigh of relief when the coveted determination letter from the IRS granting the exemption is received.īut that’s just the start of the paperwork and record-keeping required by the federal government as well as state and local authorities.

0 kommentar(er)

0 kommentar(er)